SMA India: A Market Blessed with Abundant Sunshine

SMA is represented in 21 countries around the world and in our series introducing new foreign companies we also highlight emergent photovoltaic markets. Today’s focus is on SMA India.

India is blessed with abundant sunshine throughout its varied landmass. However, it is only in recent years that the Government has started recognizing the potential of Solar PV as an important ingredient in the Renewable Energy mix. India has emerged as an important market in a short span, with cumulative Solar Installations crossing 1700 MW until May 2013, which is a big jump considering that less than 50 MW had been installed at the end of 2010 in the entire country.

Opportunities in Indian market

There are various reasons which make Solar PV a compelling alternate source of energy in Indian conditions. As the Indian economy grows, energy consumption has grown alongside. However, Electricity supply has not been able to keep up with this demand, and there is a continuing energy deficit of about 10%.This power shortage has resulted in blackouts being experienced on a regular basis by a large section of the population, as well as having a negative impact on economic growth.

India is a country of sub-continental dimensions, with 28 States and 7 Union Territories. There is a great diversity of geography, culture and lifestyle from state to state. However, high annual solar irradiation greater than 1600 kWh/m2 is a common factor which holds true for most States in the Indian Union. Thus, the situation is promising on the supply as well as the demand fronts. As a ‘sunbelt’ country, the scope of solar power generation is enormous, while the energy deficit ensures sustained demand.

India is heavily dependent on import of Petroleum products as well as Coal for its energy needs. Solar Utility Plants can provide an alternative to coal-based Thermal Power Plants, while PV-Diesel Hybrid and Off-Grid solutions can be used to reduce Diesel consumption. There are a large number of villages which are still unconnected to the Grid. Solar PV would be the ideal solution to provide Electricity to these villages in a decentralized manner without the need for exorbitant Capital Expenditure for Grid extension. Lastly, there is increased awareness amongst the population about the need to move from polluting sources of Energy to more eco-friendly sources like Solar.

Policy Drivers

There are different types of policies which drive Solar projects in India including Feed-in Tariffs (FiT), Renewable Power Obligation (RPO), Renewable Energy Certificate (REC) etc. Out of all the projects installed so far, the largest share has been installed using Power Purchase Agreements (PPA’s) under a Feed-in Tariff scheme initiated either by the Central Govt or one of the State Govts. The Central Govt. has introduced a Renewable Power Obligation (RPO) policy, which requires that atleast 3% of the total power sourced in the country by 2022, should be from Solar. RPO targets have been setup for different states, which will increase progressively in the coming years.

Power Distribution companies, Open Access consumers as well as captive consumers of > 1 MW capacity are supposed to fulfil their Solar RPO’s. This can be done by setting up their own Solar Plants, purchasing power from Solar producers, or buying Solar REC’s. However this will become a forceful market driver, only when RPO’s start being enforced strictly, which is not the case currently.

Finally, so called ‘parity-driven’ demand is expected to increase which will be driven by the commercial feasibility of solar energy. Electrical power is priced on a differential scale in India, with Commercial consumers like Malls, Offices and Retail Outlets paying the highest electricity Tariffs upto Rs 11/kWh, followed by Industrial consumers like manufacturing plants, and finally Residential consumers, which pay the cheapest rates (Rs 5-7/kWh). An analysis by market analyst “BRIDGE TO INDIA” shows that for the Commercial segment in a few states, solar power is already cheaper than Grid power, and more states will achieve Grid parity for the Commercial & Industrial segments in the coming years.

Challenges

Policy making related to Solar has gone through a convoluted path with several twists and turns in the Policy making process. The Central Govt sponsored National Solar Mission started off with fixed Tariffs for Utility projects, then changed the rules to incorporate Reverse Bidding, and finally is considering Viability Gap Funding in the latest round of allocations. This policy incoherence has caused uncertainty at the project Bidding stage, with bankability of Solar projects still being considered a risky proposition.

Adding to the confusion, are the divergent requirements of the various State Policies. Apart from the National Solar policy, a number of states including Tamilnadu, Andhra Pradesh, Uttar Pradesh, Madhya Pradesh, Kerala, Rajasthan, Punjab, Gujarat etc. have introduced their own Solar policies. This plethora of Solar policies has provided new opportunities for the Solar industry. However, each State Solar policy has its own rules for selection of Project developers, Project Sizes allowed, Financial incentives, Wheeling charges etc, which can complicate things for Project developers.

The Feed-In Tariff for Utility scale Solar PV projects allocated under NSM Phase -1 Batch-1, was Rs 12/kWh (average) in 2010, which dropped to Rs. 8/kWh in 2011, and will come down further for allocations under Phase2- Batch -1 this year . The positive impact of this reduction is that Solar Power tariffs now matches commercial Electricity rates in some states. However, the reduction in Feed-in Tariffs also raises a challenge for companies like SMA which sell premium products, as Project Developers are now operating on wafer thin margins.

Another challenge is getting regular payments from the State Electricity Boards (SEB’s). A lot of the SEB’s are running huge losses, and have a poor record of making timely payments, which is acting as a deterrent to prospective project developers. Although enormous potential exists for usage of Rooftop Solar Systems, growth has been hampered by the lack of Technical Standards for Grid-connected PV Systems. There are no clear-cut guidelines for Grid-connection of systems at Low Voltages, and there is no policy yet for Grid Feed-In. Bureaucratic hurdles in the form of extensive approvals, delays in Statutory clearances, and availability of Grid export infrastructure often lead to unnecessary delays in project Commissioning.

Reference project

SMA has equipped another photovoltaic diesel hybrid system with Sunny Tripower inverters and the intelligent control unit SMA Fuel Save Controller. Thanks to the SMA Fuel Save Solution the system owner, a cotton mill operator in Palladam, a suburb of Tirupur in the Indian state Tamil Nadu, is able to continue production – despite daily utility grid failures – with solar energy and is saving fuel costs and reducing CO2 emissions considerably.

SMA’s Indian subsidiary

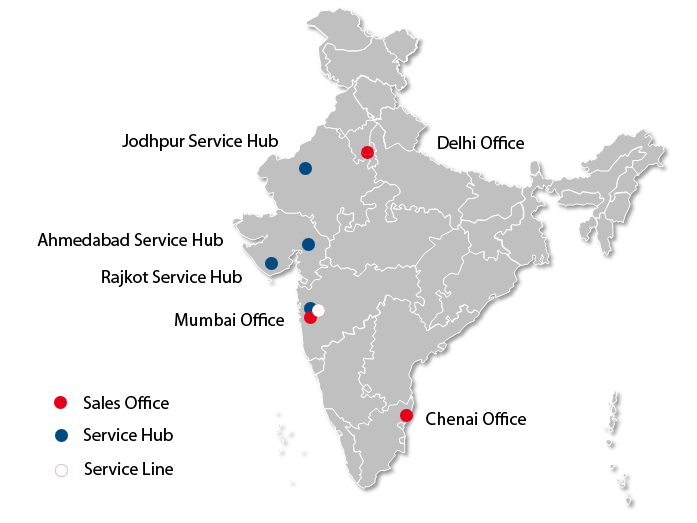

SMA opened its Indian subsidiary at an opportune time in October 2010 with Mr Rakesh Khanna joining as Country Head, when the market was about to expand rapidly. Since then, SMA has established itself as the largest Inverter supplier in the country. The SMA India team has also grown to 28 employees, spread across 6 locations.

In the initial days, when the Service team was smaller, it was frequently supported by Engineers from Korea and Germany. However, now the SMA India Service team is itself supporting the Service demands of a number of countries in Asia.

A Solar Academy was established last year, at the headquarters of SMA India in Mumbai. The Solar Academy is equipped with Central, String and Off-Grid Inverters and has provided Training to a number of Indian customers, as well as new SMA employees.

SMA supplied Sunny Central outdoor Inverters for the 40 MW project installed by Azure Power in Nagaur, Rajasthan, which is one of the largest projects in India. SMA has also Commissioned a large number of projects in desert-like environments with dry and hot climate and frequent sandstorms.

Currently, the Indian Solar market is skewed towards Utility-scale plants, as the majority of the Solar capacity installed so far is fitted with Central Inverters. However, the small-scale decentralized Solar segment is poised for takeoff as Solar tariffs come close to electricity rates, in a number of states across India.

Profile of India

Profile of India

1.2 billion inhabitants (Germany: 81.7 million)

Area: 3.287.000 km², usable land area for PV: 43,75 % (Germany: 357,121 km²)

300 sunny days per year (Germany: 275 sunny days per year)

5 percent economic growth (2012) (Germany: 0.7 percent)

Conclusion

In conclusion, India has already emerged as an attractive market for Solar PV applications. While the policy environment is still evolving, there is great potential for growth in all segments of the PV market. With excellent solar radiation through the year and falling solar energy prices, solar energy will become more attractive for end consumers, leading to greater adoption by different sets of customers.

Contact

SMA Solar India Pvt Ltd Limited

Sigma, 1101, Technology Street Hirananadani, Powai. Mumbai

400076 India

Tel. +91 (22) 6171 3800

Fax +91 (22) 6171 3838

Excellent article Mr. Piyush

Dear Mr. Varshney,

thank you! We’re glad you like our blog article!

Stay tuned as we’ll have more interesting articles about India and the rest of the world coming up.

Kind regards,

Henrik Schenck